Empowering tomorrow’s leaders. Mission

DAO 3.0: Ultimate Legal Structuring for DAOs in 2025 and Beyond

Summary: This article explores Harmony Framework – the latest and most comprehensive playbook for the legal structuring of DAOs and Web3 collectives. Discover how DAOs can transition into DAO 3.0 by creating secure, scalable and modular legal architecture, and addressing critical challenges, such as absence of legal identity, unlimited member liability, financial exposure, governance enforceability and scalability issues.

Authors:

Partner

The Legal Crisis of DAOs

Decentralised Autonomous Organisations (DAOs) have redefined collective action and governance, marking a significant step toward true on-chain democracy. However, as DAOs have grown in complexity and scale, they have collided with traditional legal systems, struggling to fit within legal frameworks that remain jurisdiction-based and entity-centric. This fundamental mismatch often creates substantial legal, financial, and governance risks for DAOs that lack a proper legal structure.

In February 2025, the Harmony Framework was introduced – a jurisdiction-neutral, modular, and scalable DAO legal architecture that balances decentralisation with legal recognition. The framework enables DAOs to operate across multiple jurisdictions while protecting their members, assets, and contributors from legal and financial risks.

The release of Harmony comes at a critical time. The legal landscape surrounding DAOs is intensifying, with courts and regulators increasingly targeting decentralised organisations. Courts have repeatedly ruled that DAOs without proper legal structuring can be classified as unincorporated partnerships, exposing members, governance participants, and even passive investors to personal liability.

A landmark example is the Samuels v. Lido DAO ruling, which confirmed that all DAO members and even large institutional backers, which in this case included Paradigm, Andreessen Horowitz and Dragonfly, could be considered legal partners. This classification makes them directly responsible for the DAO’s liabilities. Similar legal arguments were used in cases against bZx DAO and Ooki DAO, reinforcing the urgent need for DAOs to adopt comprehensive legal structures that fully wrap their governance, community, and major assets.

The Lido ruling effectively dismantled the concept of “entityless” DAOs, which proposed that DAOs could function as legal voids, with only selected components structured within corporate entities while the larger on-chain organisation remained legally undefined. This case makes it clear that DAOs have to establish proper legal structures to protect members, mitigate financial risks, and ensure long-term scalability.

Why Current DAO Structuring Approaches Fail

Most existing DAO legal structures fall into one of two fundamentally flawed categories:

Unstructured DAOs: These DAOs operate without any legal entity, leaving governance, treasury, and contributors fully exposed to legal risks. Without a defined legal structure, all DAO transactions and activities remain legally unwrapped, meaning that DAO members can be held personally liable for any obligations or actions undertaken by the DAO; or

Partially Wrapped DAOs: Some DAOs establish legal wrappers to hold specific assets, like treasury, or engage in particular activities. While these partial wrappers may provide limited liability protection for certain transactions in which the wrapper is engaged, the broader DAO – including its governance and community – remains legally unstructured.

These structuring models introduce severe legal and operational risks, as DAOs without a full legal structure in place:

- Lack legal identity, making them vulnerable to lawsuits that impose legal classifications and obligations in the most disadvantageous ways possible.

- Expose members to personal liability, making governance participants, contributors, and multisig signers legally responsible for the DAO’s operations and activities.

- Face significant tax risks, as unstructured DAOs lack a recognised tax status, making it impossible to properly manage, discharge, or comply with tax obligations. DAO members and contributors may also incur personal tax liabilities due to unstructured operations.

- Struggle to scale, because fragmented or undefined legal structures introduce inefficiencies and operational barriers, deny legal and operational scaling, and cannot support sustainable growth.

- Face governance enforceability flaws, as the absence of a proper legal structure prevents the DAO from taking timely and effective legal action, further allowing bad actors to challenge the legal validity of DAO governance decisions.

- Remain jurisdictionally fragile, as the majority of existing DAO structuring models focus on specific jurisdictions or partial legal solutions, rather than providing a truly cross-border legal framework capable of supporting large-scale decentralised ecosystems.

Secure, Modular and Scalable Legal Architecture for DAOs

Before discussing legal architecture and structuring technique, it is essential to introduce a new key concept – the DAO-Specific Entity (DSE).

A DSE is a nonprofit (or not-for-profit) legal entity that:

Recognises all token holders as members based solely on their token holdings, without requiring KYC or doxxing (except for UBOs), effectively “wrapping” the community and governance within a legally secure perimeter.

Provides default limited liability to each member, grounded in corporate law, ensuring that token holders can never be held personally liable for the DAO’s actions or obligations.

Enables effective legal, tax, and financial risk management.

It is essential to distinguish between a DSE as a “full” DAO wrapper and other “partial” wrappers. A partial wrapper refers to a legal entity deployed to isolate or wrap specific DAO assets, activities, or components, without encompassing the entire organisation – particularly its governance and community.

In contrast, deploying a DSE as a full wrapper means that the DAO fully transitions into that DSE, effectively merging with it to form a single unified legal entity. From that point onwards, the core of the decentralised organisation continues its existence in the form of the DSE.

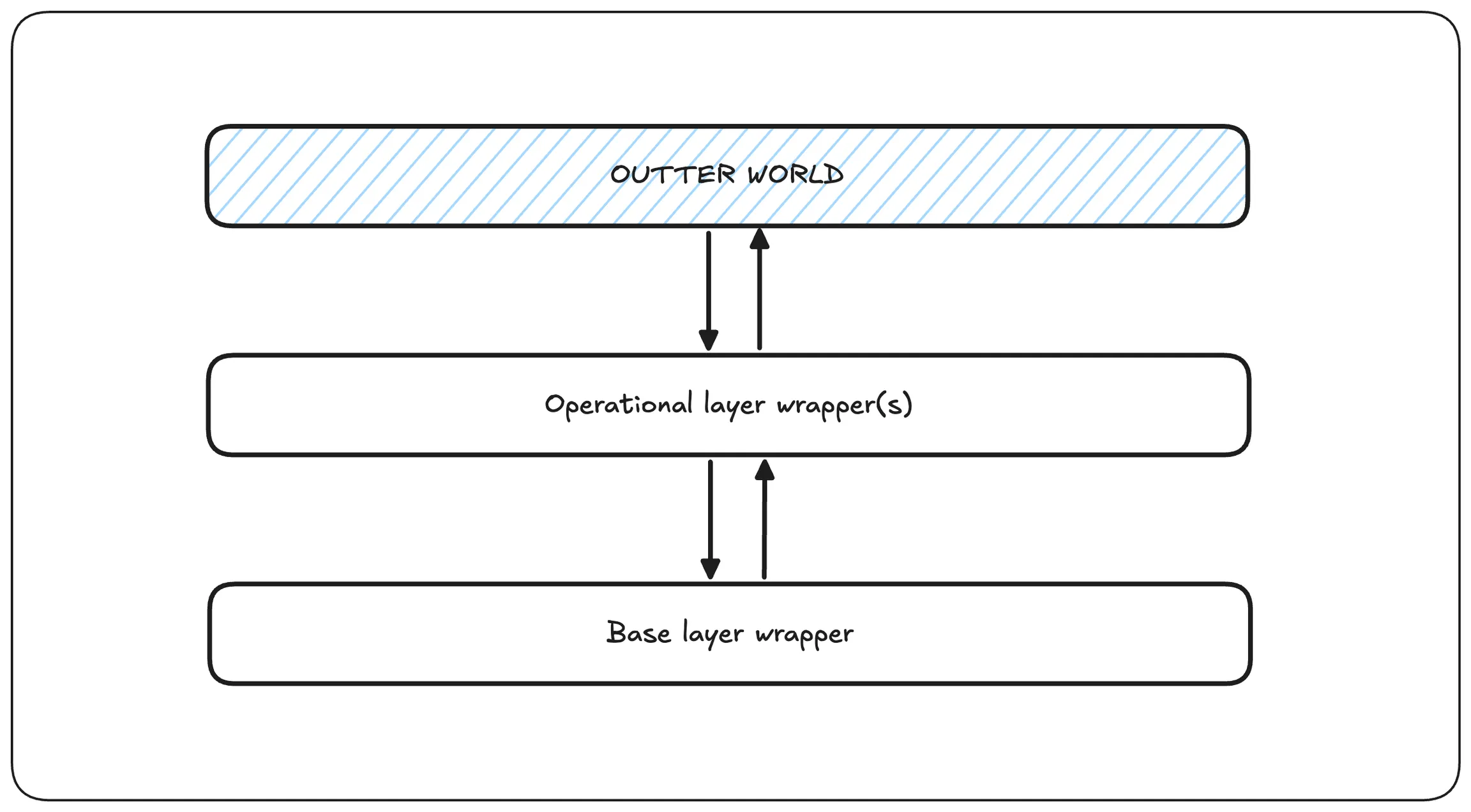

Layered Design

To achieve modular and scalable legal architecture, DAOs must adopt a layered model. This approach consists of two core structuring layers:

The Base Layer: At the Base Layer, a single DAO-Specific Entity is deployed to wrap the DAO’s governance and community within a legally-secure perimeter. The DSE serves as the DAO’s legal identity, granting default limited liability protection to all token holders and ensuring that legal systems recognise the DAO as a distinct legal entity, separate from its members.

The Operational Layer: The Operational Layer consists of additional legal wrapper(s), deployed alongside the DSE to manage or isolate specific DAO assets, activities, or risks. These wrappers are modular and deployed as needed to address the specific requirements of each particular DAO, such as holding and isolating assets, managing risks, forming sub-DAOs, committees, or structuring separate projects.

An oversimplified Illustration.

An oversimplified Illustration.

The proposed structuring approach ensures both flexibility and legal resilience, allowing DAOs to scale efficiently, maintain decentralisation, and operate globally, including within various legal systems and frameworks.

Furthermore, it enables the DAO to achieve all key objectives of legal structuring, effectively addressing critical legal risks and implications. This results in:

- DAO obtaining separate legal identity and personhood, which ensures that legal systems view the DAO as a distinct entity and eliminates the risk of forced classifications under laws of unfavourable jurisdictions.

- Limited liability of DAO members, ensuring that token holders and contributors are never personally liable for the DAO’s obligations or actions.

- Financial security and tax compliance, since being a legally recognised entity, the DAO can manage its tax and compliance obligations, preventing liability from passing through to DAO members and avoiding undesired personal tax implications.

- Cross-border legal interoperability, allowing DAOs to structure operations both globally and across specific jurisdictions – by deploying relevant Operating Layer wrappers.

- Stronger governance enforceability, as both the DAO members and their governance votes now have a clear and legally binding status, making the governance legally enforceable and reducing risks from bad actors or governance attacks.

- Scalability and adaptability, allowing DAOs to grow, evolve, and integrate additional structuring elements as needed.

- Jurisdictional flexibility, enabling DAOs to organise in favourable legal environments.

Modularity and Scalability

Having a distinct Operational Layer allows DAOs to become modular and remain scalable in the long run. At this layer, DAOs can deploy as many partial wrappers as needed to structure specific assets, activities, or projects.

Beyond scalability, the key advantage of this structure is risk isolation. Each Operational Layer wrapper is a separate legal entity, ensuring that liabilities from high-risk activities do not extend to the DAO’s governance or treasury.

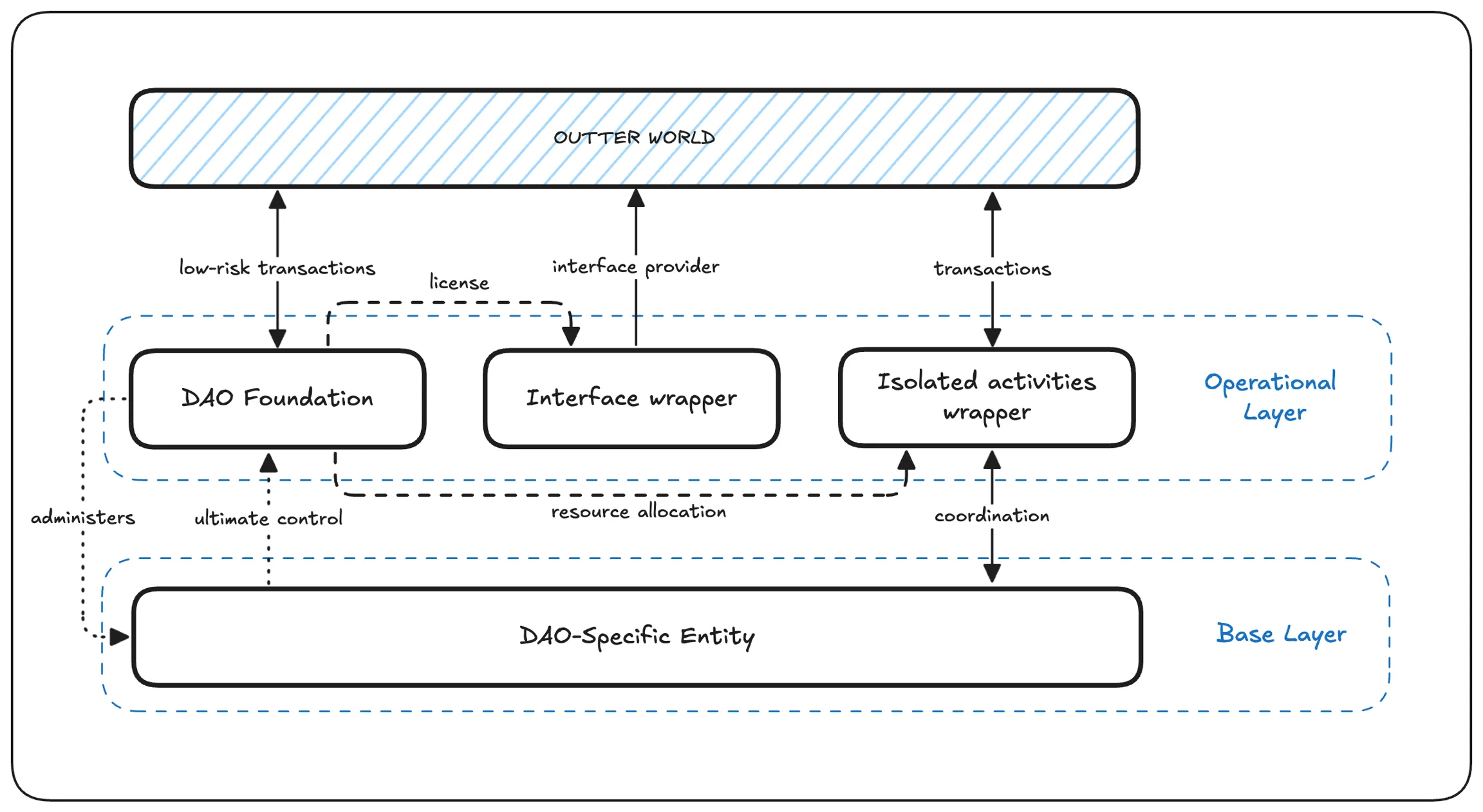

The Operational Layer wrappers fall into two categories:

Subordinate wrappers include entities that have to be ultimately controlled by the DAO governance, like holding wrappers; now, instead of subordinating a wrapper to the DAO as “token holders” or “community” without legal identity, it can be subordinated to the DSE, providing a stronger position to enforce governance decisions and take timely legal action.

Autonomous wrappers operate within the DAO ecosystem but remain independent of the DAO; by delegating specific authority or assets to autonomous wrappers, the DAO enhances flexibility and inclusivity, and advances its decentralisation.

Illustration of an Operational Layer Encompassing Subordinated and Autonomous Wrappers. In the scheme above, control refers to certain powers, like appointment of managers.

Illustration of an Operational Layer Encompassing Subordinated and Autonomous Wrappers. In the scheme above, control refers to certain powers, like appointment of managers.

This flexible and modular architecture enables DAOs to grow efficiently, evolving into complex, cybernetic organisations that can adapt to different legal environments with agility.

Treasury and Distributions

Since DSEs are structured as not-for-profit entities, they cannot distribute assets among its members, potentially limiting the DAO’s flexibility regarding treasury use. On the other hand, leaving significant DAO assets, such as the treasury, unwrapped could perpetuate legal ambiguity: the unwrapped treasury and collective management efforts might be viewed as a separate co-existing arrangement, potentially qualifying as a general partnership or unincorporated association, potentially leading to adverse legal implications.

Given the above, we are confident that the treasury and significant DAO assets must be wrapped within an appropriate legal wrapper. However, the determination of whether this should be the Base Layer DSE or a Operating Layer wrapper(s), as well as the choice of its form, jurisdiction, and tax status (for/nonprofit), should be made on a case-by-case basis for each decentralised organisation.

For instance, it is still possible to introduce mechanisms to reward those actively contributing to the organisation’s mission. Operating Layer wrappers can be used to manage incentive mechanisms outside the DSE’s nonprofit perimeter. At the same time, any rewards should be linked to meaningful contributions, such as active participation, development efforts, or governance responsibilities, rather than passive token holding.

Substance

The legal structure of a DAO must be substantive, not merely formal, to ensure effectiveness and credibility, and that it is not perceived as a fiction. This means the DAO’s legal architecture should reflect its operational framework, without introducing substantial changes to the governance, operational, or decision-making processes unless required.

The key components — such as the treasury, multisig wallets, and core committees — should be integrated into the legal framework in some way. If significant elements of the DAO remain outside the structure, the DAO risks continuing to function as a general partnership, with its legal wrappers seen as additional partners rather than a fully wrapped and cohesive entity.

By focusing on substance over form, DAOs can create a legal structure that not only reflects their operations but also enhances their legitimacy and resilience.

Regulatory Wrap-Up

There’s no one-size-fits-all when it comes to regulations, especially across borders. However, we believe that implementing the proposed structure is unlikely to negatively impact a DAO’s legal status, compliance, or governance token classification. The framework preserves the status quo in areas like operations and decision-making while enhancing others, such as separating economic rights from governance tokens.

Choice of Corporate Form

Base Layer

Currently, several DAO-Specific Entities are available for establishing a Base Layer structure. Unlike traditional legal entities, DSEs are explicitly designed to align with the decentralised and token-based membership models of DAOs. Some of the available options include:

DAO LLC: An LLC form that is specifically designed for decentralised organisations. Presently, we consider Marshall Islands a go-for jurisdiction for setting-up the Base Layer structure in the form of DAO LLC.

DUNA: A Wyoming (US) decentralised nonprofit association that is an ideal choice for any DAO that has a US nexus or wants to establish one.

RAK DAO Association: A nonprofit association in Ras Al-Khaimah, a Web3-focused UAE free zone. A good choice for those looking to establish an onshore DSE structure.

ADGM DLT Foundation: A specialised form of DAO foundation that is available in the ADGM Free Zone, UAE.

Operational Layer

Entities at the Operational Layer are typically responsible for specific DAO assets or DAO-related operations and can serve various purposes, such as structuring committees or sub-DAOs, segregating assets, holding and managing IP, wrapping specific material transactions, isolating high-risk activities, or structuring associated projects.

The Operational Layer is modular, with no limit to the number or types of wrappers a DAO may deploy. Having a DSE at the Base Layer strengthens subordination and control capabilities, making it easier to use traditional corporate forms—like corporations, onshore and offshore companies—as subordinate wrappers.

Examples of Operational Layer wrappers include:

- Ownerless entities like foundations and companies limited by guarantee.

- Purpose trusts.

- Segregated portfolio companies (SPCs).

- Protected cell companies (PCCs).

- Series of DAO LLC (where DSE is a DAO LLC).

- Sub-DAOs (where DSE is a RAK DAO Association).

- Traditional legal entities like corporations, LLCs, onshore and offshore companies, etc.

Conclusion: The Future of DAO Legal Structuring

DAOs can no longer afford to remain legally unstructured. As regulatory scrutiny intensifies and legal precedents establish clear liability risks for unwrapped and partially wrapped DAOs, the need for robust, scalable, and decentralised DAO legal architecture has never been greater.

As regulatory environments evolve, further experimentation and adaptation will likely be necessary to balance legal compliance with the fundamental principles of decentralised governance. But for DAOs seeking long-term sustainability, legal security, and global scalability, the DAO 3.0 journey starts here, with Harmony.